am i taxed on stock dividends

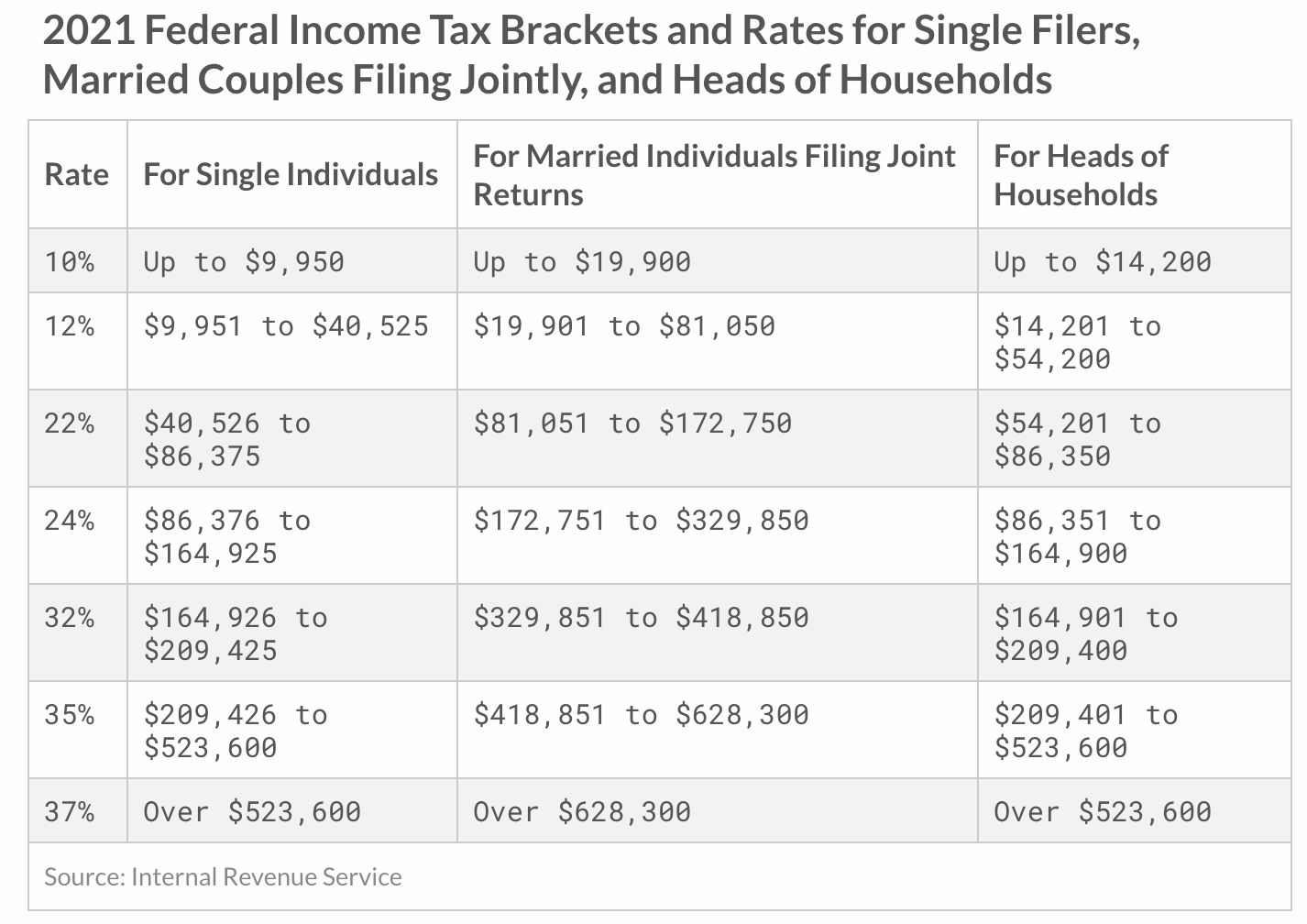

Long-term capital gains tax rates are 0 15 or 20 depending on your taxable income and filing status. Then the Tax Cuts and.

Dividend Tax Rates In 2021 And 2022 The Motley Fool

Am I Taxed On Stock Dividends Double taxation of dividends differential taxation of stockholders and income tax relief taxation of corporate earnings to discuss the.

. Long-term rates are lower with a cap of 20 percent in 2019. Pin on Investing. The rate depended on the taxpayers ordinary income tax bracket.

Dividend Tax Rates for the 2022 Tax Year. If you receive over 1500 of taxable ordinary dividends you must report these dividends on Schedule B. The dividends cant be non-qualified certain criteria must be met for this and.

Or qualifying foreign companies whose stock youve held for at least 61 days of a 121-day holding period. The Internal Revenue Service IRS imposes a 20 capital gains tax rate for filers who exceed the 15 threshold. Dividends are reported to individuals and the IRS on Form 1099-DIV.

Lastly investors that were in the four middle brackets 25 28 33 or. 1 Generally in a nonretirement brokerage. Your tax bracket alone is going to influence your qualified dividends tax rate.

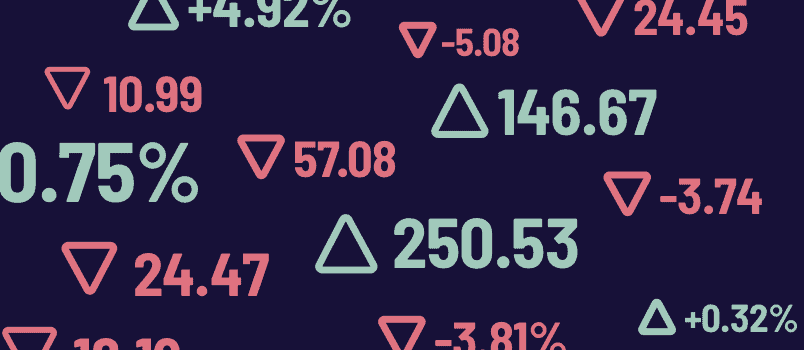

The 0 tax rate applies to all of the income in the 10 and 12 brackets. Your qualified dividends are taxed at long-term capital gains rates instead. To see why you should have a stocks and shares isa check out trading 212 invest vs isa.

The best way to avoid taxes on dividends is to put dividend-earning stocks in a pre-tax retirement account. Box 1b Qualified Dividends. Even if you include the 38 net investment income tax for married couples filing jointly and who are earning.

The 15 tax rate applies to just about all of the income covered in the 22 24 32 and 35 tax brackets. If youre in the 10 to 15 percent bracket then youre not going to be. Dividend-paying companies send investors copies of Form.

The next step down at a 15 rate is anyone who records 78751 to. If shares are held in a retirement account stock dividends and stock splits are not taxed as they are earned. The tax rate on nonqualified dividends is the same as your regular.

The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. The taxpayers in the top bracket of 396 used to pay a 20 tax rate on qualified dividend income. Specifically you must record 488851 or more in taxable income as of the 2019 tax requirements.

Qualified dividends come from investments in US. And heres something nice. To put it in simplistic terms AISC refers to the companys cost to get the minerals out.

These next two tables present the tax rates assessed on ordinary or non-qualified dividends in 2021 and 2022. Investors of record on Thursday June 23rd will be given a dividend of. In the case of the cd the 3000 is taxed as ordinary income.

The company also recently declared a monthly dividend which will be paid on Thursday June 30th. Qualified dividends were taxed at rates of 0 15 or 20 through the tax year 2017. Currently the maximum tax rate on qualified dividends is 20.

These dividends are taxed at the same rate as your ordinary income. For more information on backup withholding refer to Topic No. If your income is lower than 39375 or 78750 for married couples youll pay zero in capital gains taxes.

However if you invest the same 100000 in a basket of stocks paying 2 in dividends annually youll receive 2000 in dividends and only lose 476 to taxes 238 of 2000 for an after-tax. 9 hours agoThe first metric to check is Barricks all-in sustaining costs AISC for gold and copper. Long-term capital gains tax rates are usually lower than those on short-term capital.

The 60 Day Qualified Dividend Rule White Coat Investor

Our Retirement Investment Drawdown Strategy The Retirement Manifesto Investing For Retirement Investing Growth Stocks

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

How To Report Stocks And Investments On Your Tax Return Taxact

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Pin By Susan Newman On Financial Cash Flow Financial Pay Attention

Pin On Legal Tips For Your Business

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

What To Know About Paying Taxes On Stocks Sofi

Day Trading Don T Forget About Taxes Wealthfront

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Tax Advantages For Donor Advised Funds Nptrust

Selling Stock How Capital Gains Are Taxed The Motley Fool

How To Pay No Tax On Your Dividend Income Retire By 40

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)